Find a medical insurance plan in Wisconsin that’s right for you

Buying your own insurance because you retired early or you’re self-employed? Not getting insurance through your work? We’re here to help with affordable plans that feature strong provider networks, award-winning Member Services and extra perks that make a difference.

Select your region below to get started.

Keep your current doctors with a network designed around high-quality care at affordable costs.

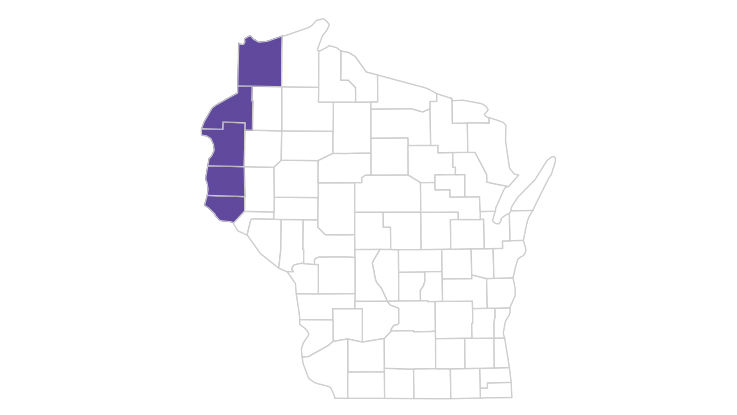

The Individual Atlas network

The Atlas network provides access to top care providers in western Wisconsin. It includes HealthPartners, Park Nicollet, Burnett Medical Center, Essentia Health, Hudson Physicians, Aspirus St. Luke’s and more.

All plans come with coverage for prescription drugs through our PreferredRx formulary (drug list). Specific coverage levels vary by plan – see your plan documents for more details.

2025 individual and family plan details

Want to know what kind of coverage you can expect? Take a look below at the coverage highlights of our self-purchased medical insurance plans. You’ll get a personalized monthly premium based on information you enter when you

Below are the plans we offer directly (you may find more HealthPartners options if you shop at

The chart lists what you pay:

| Plan name | Deductible | Office visits | Coinsurance | Out-of-pocket max |

|---|---|---|---|---|

| $8,200 HSA Bronze | $8,200 (individual) / $16,400 (family) | 0% after deductible | 0% after deductible | $8,200 (individual) / $16,400 (family) |

| $7,500 P-S w/ Copay Bronze | $7,500 (individual) / $15,000 (family) | $50 or $100 copay | 50% after deductible | $9,200 (individual) / $18,400 (family) |

| $6,500 Plus Bronze | $6,500 (individual) / $13,000 (family) | $30 copay (first three) then 30% after deductible | 30% after deductible | $9,200 (individual) / $18,400 (family) |

| $5,000 P-S w/Copay Silver | $5,000 (individual) / $10,000 (family) | $40 or $80 copay | 40% after deductible | $8,000 (individual) / $16,000 (family) |

| $3,850 Plus Silver | $3,850 (individual) / $7,700 (family) | $30 copay (first three) then 20% after deductible | 20% after deductible | $8,500 (individual) / $17,000 (family) |

| $3,500 HSA Silver | $3,500 (individual) / $7,000 (family) | 20% after deductible | 20% after deductible | $7,500 (individual) / $15,000 (family) |

| $2,650 Plus Silver | $2,650 (individual) / $5,300 (family) | $30 copay (first three) then 20% after deductible | 20% after deductible | $9,200 (individual) / $18,400 (family) |

| $1,500 w/Copay P-S Gold | $1,500 (individual) / $3,000 (family) | $30 or $60 copay | 25% after deductible | $7,800 (individual) / $15,600 (family) |

| $1,000 w/Copay P-S Gold | $1,000 (individual) / $2,000 (family) | $15 or $35 copay | 20% after deductible | $8,250 (individual) / $16,500 (family) |

| $9,200 Catastrophic | $9,200 (individual) / $18,400 (family) | $30 copay (first three primary care visits) then 0% after deductible | 0% after deductible | $9,200 (individual) / $18,400 (family) |

For complete details,

Extra perks that save time, money and peace of mind

No matter which plan you choose, you’ll get these additional perks (and much more) at no added cost:

- Award-winning support from our Midwest-based

Member Services team - 100% coverage for

preventive care - 24/7 health support through

CareLine℠ - Access to

Virtuwell , our online clinic where you can get care anywhere

- Personalized

well-being and rewards programs - Worldwide emergency

coverage when traveling Member Assistance Program for help with life’s challengesSupport and resources for better health

You can also call us at 877-838-4949 or email us at IndividualSales@healthpartners.com.

Keep your current doctors with robust networks that provide affordable, high-quality care.

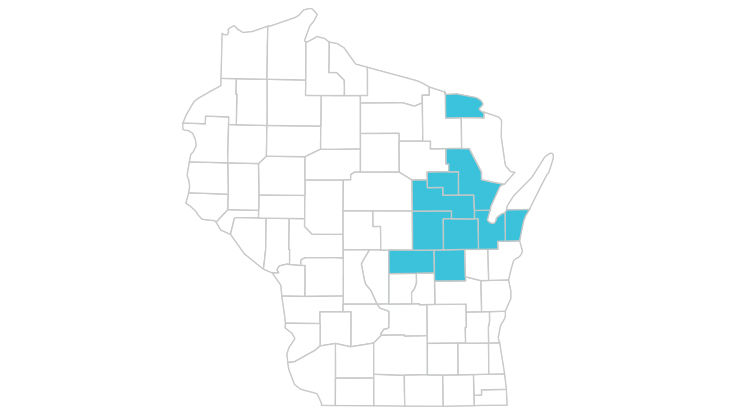

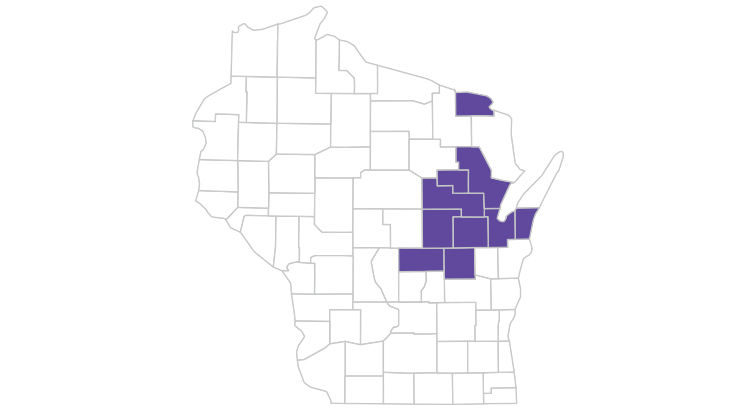

The Individual Robin Select network

The Robin Select network is designed to provide care options that are both local and affordable. The network includes all Bellin Health and ThedaCare clinics and hospitals, as well as Children’s Wisconsin.

The Individual Robin Oak network

Get access to top care options with the Robin Oak network, including Bellin Health, ThedaCare, Aurora Healthcare Hospitals & Clinics, Bay Area Medical Center, BayCare Clinic, UW Madison Hospital and more.

All plans come with coverage for prescription drugs through our PreferredRx formulary (drug list). Specific coverage levels vary by plan – see your plan documents for more details.

2025 individual and family plan details

Want to know what kind of coverage you can expect? Take a look below at the coverage highlights of our self-purchased medical insurance plans. You’ll get a personalized monthly premium based on information you enter when you

Below are the plans we offer directly (you may find more Robin with HealthPartners options if you shop at

The chart lists what you pay:

| Plan name | Network | Deductible | Office visits | Coinsurance | Out-of-pocket max |

|---|---|---|---|---|---|

| $8,200 HSA Bronze | $8,200 (individual) / $16,400 (family) | 0% after deductible | 0% after deductible | $8,200 (individual) / $16,400 (family) | |

| $7,500 P-S w/ Copay Bronze | $7,500 (individual) / $15,000 (family) | $50 or $100 copay | 50% after deductible | $9,200 (individual) / $18,400 (family) | |

| $6,500 Plus Bronze | $6,500 (individual) / $13,000 (family) | $30 copay (first four) then 30% after deductible | 30% after deductible | $9,200 (individual) / $18,400 (family) | |

| $5,000 P-S w/ Copay Silver | $5,000 (individual) / $10,000 (family) | $40 or $80 copay | 40% after deductible | $8,000 (individual) / $16,000 (family) | |

| $3,600 Plus Silver | $3,600 (individual) / $7,200 (family) | $25 copay (first four) then 20% after deductible | 20% after deductible | $9,200 (individual) / $18,400 (family) | |

| $3,500 HSA Silver | $3,500 (individual) / $7,000 (family) | 20% after deductible | 20% after deductible | $7,500 (individual) / $15,000 (family) | |

| $2,800 Plus Silver | $2,800 (individual) / $5,600 (family) | $25 copay (first four) then 20% after deductible | 20% after deductible | $8,900 (individual) / $17,800 (family) | |

| $1,500 w/Copay P-S Gold | $1,500 (individual) / $3,000 (family) | $30 or $60 copay | 25% after deductible | $7,800 (individual) / $15,600 (family) | |

| $1,000 w/Copay P-S Gold | $1,000 (individual) / $2,000 (family) | $15 or $35 copay | 20% after deductible | $8,250 (individual) / $16,500 (family) | |

| $9,200 Catastrophic | $9,200 (individual) / $18,400 (family) | $30 copay (first three primary care visits) then 0% after deductible | 0% after deductible | $9,200 (individual) / $18,400 (family) |

For complete details,

Extra perks that save time, money and peace of mind

No matter which plan you choose, you’ll get these additional perks (and much more) at no added cost:

- Award-winning support from our Midwest-based

Member Services team - 100% coverage for

preventive care - 24/7 health support through

CareLine℠ - Access to

Virtuwell , our online clinic where you can get care anywhere

- Personalized

well-being and rewards programs - Worldwide emergency

coverage when traveling Member Assistance Program for help with life’s challengesSupport and resources for better health

You can also call us at 877-838-4949 or email us at IndividualSales@healthpartners.com.